Introduction: The Allure of Tesla Stock

Tesla has quickly evolved from a niche electric car maker into one of the world’s most innovative companies. Founded in 2003 by engineers Martin Eberhard and Marc Tarpenning and later propelled to prominence by visionary CEO Elon Musk, Tesla has disrupted the automotive industry and is redefining the future of energy. Today, Tesla is a pioneer in electric vehicles (EVs), autonomous driving technology, and renewable energy solutions. With its impressive stock growth, innovative products, and charismatic leadership, Tesla has captured the imagination of investors and tech enthusiasts alike.

But investing in Tesla stock comes with its own set of complexities. Despite its meteoric rise, the stock has faced major volatility, and many investors wonder whether Tesla is a bubble waiting to burst or a game-changing company that will reshape industries. This blog post will explore the factors that affect Tesla’s stock price, its growth potential, the risks involved, and offer actionable insights to help you decide whether Tesla stock belongs in your portfolio.

Table of Contents

- What is Tesla Stock?

- Tesla’s Historical Stock Performance

- Factors Influencing Tesla Stock Price

- Tesla’s Growth Potential: A Look at the Future

- Risks of Investing in Tesla Stock

- How to Invest in Tesla Stock

- Tips for Investors: Making the Most of Tesla Stock

- FAQs about Tesla Stock

- Conclusion: Is Tesla Stock a Good Investment?

1. What is Tesla Stock?

Tesla, Inc. (NASDAQ: TSLA) is a publicly traded company that designs and manufactures electric vehicles and clean energy products. The company is known for its high-performance electric vehicles, such as the Model S, Model 3, Model X, and Model Y. Tesla’s products also include solar panels and energy storage systems, such as the Powerwall and Powerpack, which are designed to promote renewable energy consumption.

Tesla’s stock represents ownership in the company, allowing shareholders to participate in its growth, earnings, and the potential rise in the company’s market value. When you buy Tesla stock, you’re essentially betting on the future success of the company, which could be influenced by everything from advancements in EV technology to Musk’s leadership style and the company’s ability to meet production targets.

Tesla’s Stock Split and What It Means

Tesla has conducted multiple stock splits, the most recent being in 2020, when the company executed a 5-for-1 split. A stock split makes shares more affordable by increasing the number of shares in circulation without affecting the overall value of the company. This move is often seen as a signal of confidence in the company’s future. For example, after the 2020 stock split, Tesla’s shares were trading at a lower price, making it accessible to a wider range of retail investors.

2. Tesla’s Historical Stock Performance

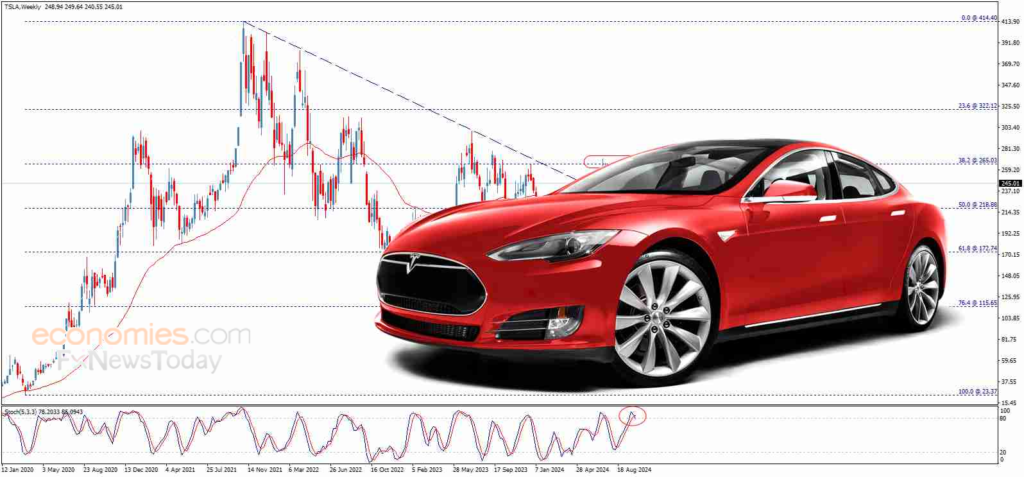

Tesla’s stock history has been anything but conventional. Unlike most companies that gradually grow in stock value over time, Tesla’s journey has been marked by significant volatility. Understanding its past can help investors better anticipate future price movements and market reactions.

Early Years (2010-2015)

Tesla’s public debut in 2010 was met with skepticism. Priced at $17 per share during its initial public offering (IPO), many investors were unsure about the viability of electric vehicles, especially those coming from a startup. Tesla’s initial years as a public company were marked by struggles with production, financial sustainability, and market perception.

However, in 2013, Tesla proved its doubters wrong. The Model S, Tesla’s first mass-produced vehicle, garnered widespread acclaim for its performance, safety features, and long-range battery capabilities. Tesla’s stock price surged, and by 2014, the company was seen as one of the most innovative automakers globally.

The Growth Surge (2016-2020)

The years 2016-2020 were critical in shaping Tesla’s stock trajectory. With the launch of the Model 3 in 2017, Tesla solidified itself as a serious contender in the electric vehicle market. The Model 3 was Tesla’s first mass-market vehicle, and it attracted a massive global customer base. This was a turning point for the company and its stock, with shares trading as high as $500 per share by mid-2020.

In 2020, Tesla became a member of the S&P 500, further solidifying its place in the market as a heavyweight. Despite global disruptions caused by the COVID-19 pandemic, Tesla’s stock surged in 2020, with the company exceeding delivery expectations and seeing a massive rise in its stock price.

Recent Trends and Volatility (2021-Present)

As of 2021 and 2022, Tesla’s stock faced volatility due to a combination of factors: the global chip shortage, market sentiment toward technology stocks, and Tesla’s own growth challenges. However, the company’s market capitalization continues to hover around $700 billion to $1 trillion, making it one of the largest automakers by market value.

In 2023, Tesla’s stock experienced a significant drop, largely due to Musk’s involvement with Twitter, the company’s ongoing production challenges, and increasing competition from other automakers. Despite this, Tesla remains a key player in the electric vehicle market, and its stock continues to generate significant interest among investors.

3. Factors Influencing Tesla Stock Price

Tesla’s stock price is influenced by numerous factors, both internal and external. Let’s explore some of the most important elements that contribute to stock price movements.

1. Elon Musk’s Leadership and Influence

Elon Musk’s influence on Tesla is arguably the most significant factor affecting the stock. As CEO, Musk’s bold vision, innovative ideas, and even his social media presence have a direct impact on the market. His Twitter account, for example, is often scrutinized for market-moving statements, whether it’s about Tesla’s next product, a new business venture, or even a meme. This influence works both ways: Musk’s enthusiastic declarations about Tesla’s future can drive the stock price up, while his controversial tweets can cause it to drop.

2. Production and Delivery Numbers

Tesla’s stock price is highly sensitive to its ability to meet production targets and deliver vehicles on time. Every quarter, Tesla releases production and delivery reports, which investors closely watch. Failing to meet these expectations can cause the stock price to drop, while exceeding expectations can send it soaring.

For instance, in 2020, Tesla experienced delays in the production of its Model Y, but once it began to ramp up production and meet customer demand, the stock saw a significant boost. Investors are always looking at Tesla’s production numbers to gauge the company’s growth trajectory.

3. Technological Innovation

Tesla’s reputation as a technology company is rooted in its ability to innovate. The company has pioneered several groundbreaking technologies, including:

- Autopilot: Tesla’s self-driving technology, which has made significant advancements over the years.

- Battery Technology: Tesla’s energy storage solutions, including the Powerwall, are seen as pivotal in the renewable energy revolution.

- Solar Products: Tesla’s solar panels and Solar Roof products are part of its vision to create a sustainable energy ecosystem.

Innovations in any of these areas can result in positive price movements, as investors bet on the company’s continued dominance.

4. Market Competition

As more traditional automakers and startups enter the EV space, competition is intensifying. Companies like Rivian, Lucid Motors, and traditional automakers such as Ford and General Motors are aggressively pushing into the electric vehicle market. While Tesla remains the market leader, the rise of competitors can create pressure on its market share and affect the stock’s performance.

5. Global Economic and Regulatory Factors

Tesla is subject to global economic trends and government policies. For instance, government incentives for electric vehicles can boost Tesla’s sales, while adverse regulatory decisions or changes in tax policies can affect its profitability. Moreover, changes in interest rates, inflation rates, and consumer spending power can influence stock prices.

4. Tesla’s Growth Potential: A Look at the Future

Tesla is often seen as a growth stock, meaning that investors are buying into the company’s future potential rather than its current financials. Let’s take a closer look at the key areas where Tesla’s growth potential lies.

1. Expansion of EV Market Share

The global market for electric vehicles is expanding rapidly. With increasing concerns over climate change, rising fuel prices, and government mandates for reducing emissions, more consumers are opting for electric vehicles. Tesla is poised to capitalize on this global shift, especially with the introduction of its more affordable models such as the Model 3 and Model Y.

Tesla’s Gigafactories, including its plants in Shanghai, Berlin, and Austin, are designed to ramp up production and meet the increasing demand for EVs worldwide. These factories will play a crucial role in Tesla’s ability to capture more market share in both developed and emerging markets.

2. Renewable Energy Solutions

Tesla’s clean energy solutions, including its solar panels and energy storage products, position it as a leader in the renewable energy sector. As the world moves toward more sustainable energy sources, Tesla’s solar products and Powerwall systems are likely to experience growth. For example, the company has been involved in large-scale projects, such as the Solar Roof initiative and providing energy storage solutions for utilities, that have the potential to revolutionize the energy industry.

3. Autonomous Driving

Tesla’s efforts in autonomous driving have garnered much attention. The company’s “Full Self-Driving” (FSD) software continues to evolve, with Tesla cars already equipped with advanced driver assistance systems (ADAS). If Tesla can achieve fully autonomous driving—where cars can drive themselves without human intervention—it could revolutionize the transportation industry and create new revenue streams, such as autonomous ride-hailing services.

4. Expansion into New Markets

Tesla has already expanded its footprint beyond North America, with significant manufacturing and sales operations in China, Europe, and more recently, India. The global nature of the EV market presents an opportunity for Tesla to capture new customers and increase its market share, especially in emerging markets.

5. Risks of Investing in Tesla Stock

Despite the company’s many strengths and growth potential, Tesla stock is not without risks. Let’s explore some of the challenges that investors must be aware of:

1. Market Volatility

Tesla is known for its extreme volatility. The stock has seen dramatic price swings, sometimes based on external factors, such as Musk’s comments or global economic trends. This makes Tesla stock suitable for risk-tolerant investors who can handle price fluctuations but potentially unsuitable for conservative investors looking for stable returns.

2. Production and Supply Chain Issues

Tesla’s ambitious production goals often run into challenges. The company has faced delays, shortages in materials, and issues scaling production. For instance, Tesla had trouble scaling the production of the Model 3 and encountered supply chain issues during the COVID-19 pandemic, which impacted vehicle deliveries.

3. Competitive Threats

The EV market is becoming increasingly competitive, with legacy automakers like Ford and General Motors ramping up their electric vehicle offerings. Companies like Rivian and Lucid Motors are also gaining attention. While Tesla remains the leader, its competitors may capture some of its market share, potentially affecting its growth rate and stock price.

4. Regulatory and Legal Challenges

Tesla operates in a highly regulated environment. Changes in regulations—such as those related to emissions standards, safety features, or self-driving cars—could have a significant impact on Tesla’s operations. Moreover, Tesla has faced lawsuits and investigations regarding its Autopilot features, which could create additional risks for investors.

6. How to Invest in Tesla Stock

For investors interested in buying Tesla stock, here’s a step-by-step guide:

- Open a Brokerage Account: To buy Tesla stock, you’ll need a brokerage account. Popular platforms like Robinhood, Fidelity, and E*TRADE allow easy access to Tesla shares.

- Research Tesla’s Financials: Before purchasing stock, look at Tesla’s quarterly earnings reports and stock performance. Understanding its financial health will help you make an informed decision.

- Choose Your Investment Strategy: Decide whether you want to invest for the short-term or long-term. Long-term investors often use dollar-cost averaging (DCA) to buy shares consistently, regardless of short-term market fluctuations.

- Buy the Stock: Once you’ve decided to invest, place a market order or a limit order to buy Tesla stock. A market order buys at the current price, while a limit order buys only at a price you specify.

- Monitor Your Investment: Regularly review Tesla’s performance, product launches, earnings reports, and news about its competitors to ensure your investment remains aligned with your financial goals.

7. Tips for Investors: Making the Most of Tesla Stock

- Stay Updated: Keep track of Tesla’s latest developments, including product launches, earnings calls, and industry news. This will help you anticipate potential price movements.

- Diversify Your Portfolio: While Tesla presents a great growth opportunity, it’s important to balance your portfolio with other stocks and investments to reduce overall risk.

- Be Prepared for Volatility: Tesla stock can be very volatile. If you’re new to investing or not comfortable with significant price swings, consider adjusting your risk tolerance accordingly.

- Invest Long-Term: Tesla’s true growth potential may take years to materialize. Be prepared to hold your investment for the long haul to benefit from future growth.

8. FAQs about Tesla Stock

Q1: Why is Tesla stock so volatile?

Tesla’s stock is highly influenced by Elon Musk’s actions, market sentiment, and technological advancements. This leads to significant fluctuations in the stock price.

Q2: Should I buy Tesla stock now?

This depends on your investment goals, risk tolerance, and the amount of research you’ve done. Tesla offers growth potential, but its volatility means that it’s not suitable for all investors.

Q3: Can Tesla stock reach $2,000 per share again?

While Tesla’s past performance is impressive, predicting its future stock price is difficult due to market variables. However, continued growth in EV adoption and energy solutions could push the stock higher.

9. Conclusion: Is Tesla Stock a Good Investment?

Tesla stock represents both tremendous opportunity and significant risk. The company’s leadership in the electric vehicle and clean energy markets offers investors the chance to participate in a rapidly growing industry. However, Tesla’s volatility, competition, and regulatory risks are important factors to consider.

Ultimately, Tesla’s stock is best suited for those with a high risk tolerance who believe in the company’s long-term potential. As always, conduct thorough research, understand the risks, and consult a financial advisor to determine if Tesla fits into your overall investment strategy.

Call-to-Action: What do you think about Tesla’s stock? Are you planning to invest or already holding shares? Join the conversation by leaving a comment below or sharing your insights with your network.